Michigan Exemption Allowance 2025. 50% of the 2025 amount. The death of an individual entitled to family allowance terminates the right to allowances not yet paid.

The michigan department of treasury issued a release that discusses the tax treatment of retirement and pension. 4.25% income tax rate for individuals and fiduciaries in 2025 tax year.

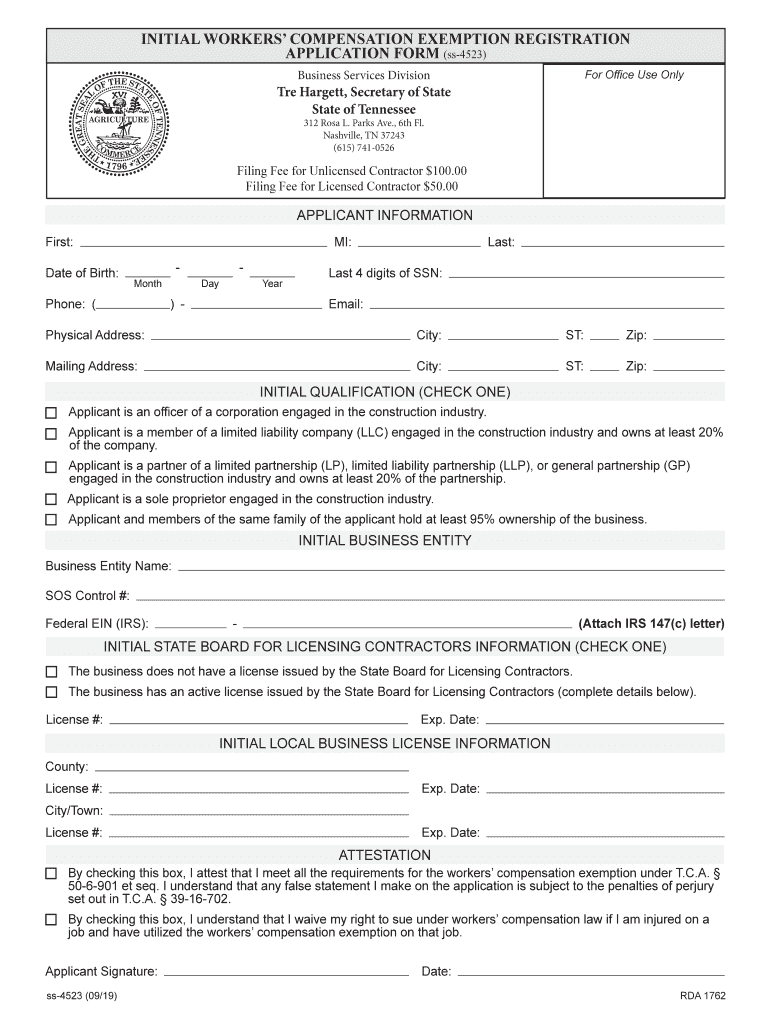

Workers Comp Exemption PDF Michigan 20192024 Form Fill Out and Sign, Calculate your annual take home pay in 2025 (that’s your 2025 annual salary after tax), with the annual michigan salary calculator. The social security wage base limit has increased from $160,200 to $168,600.

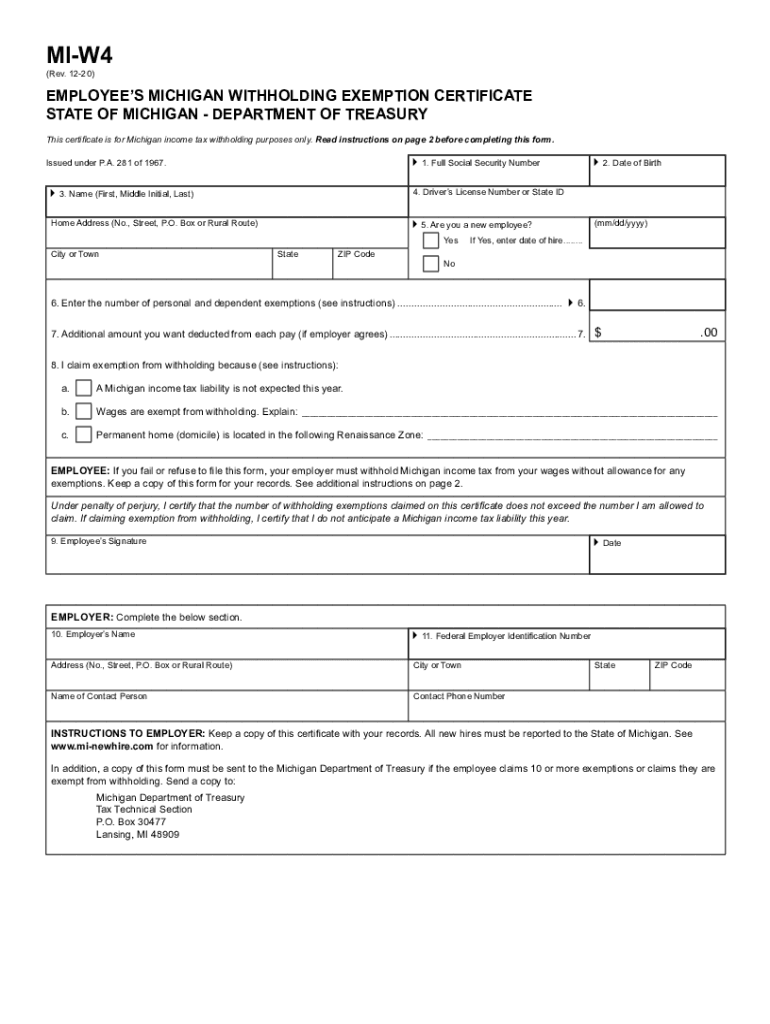

Mi W4 20202024 Form Fill Out and Sign Printable PDF Template, Gretchen whitmer, center, celebrates a “retirement tax” repeal that. Individuals and fiduciaries subject to tax under part 1 of.

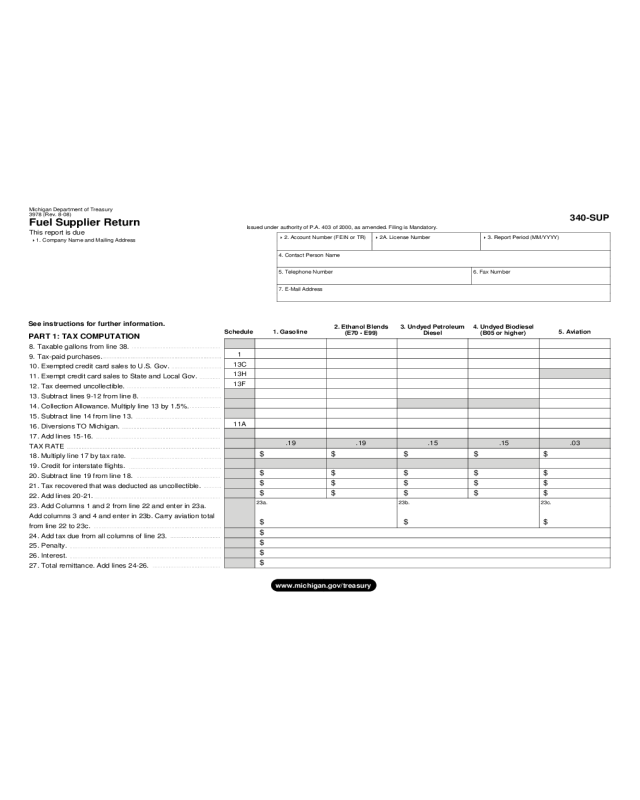

2025 Fuel Allowance Form Fillable, Printable PDF & Forms Handypdf, What are the current tax rate and exemption amounts? Michigan single filer tax tables

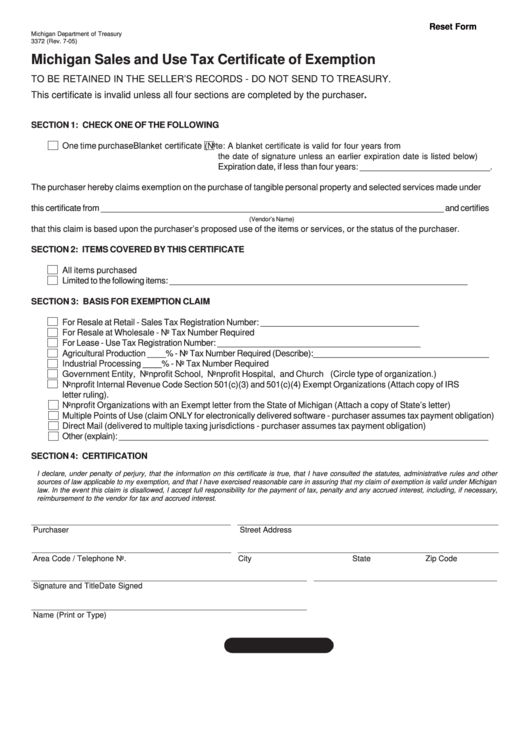

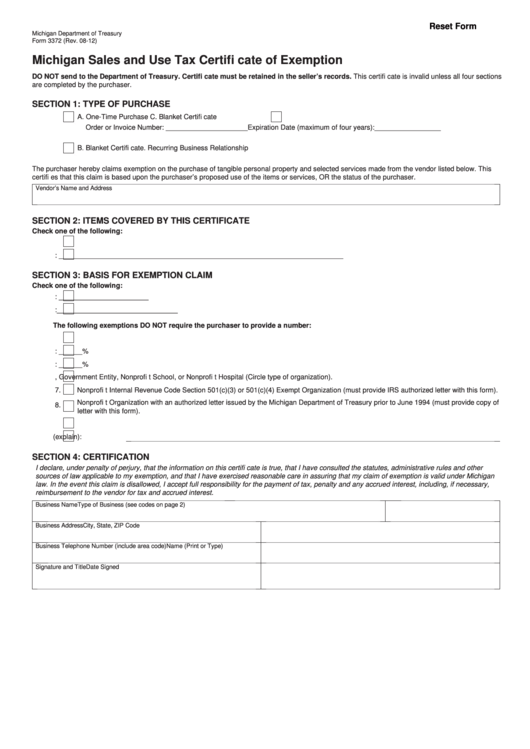

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of, Dep’t of treasury, 2025 michigan income tax. What is michigan’s 2025 personal exemption amount?

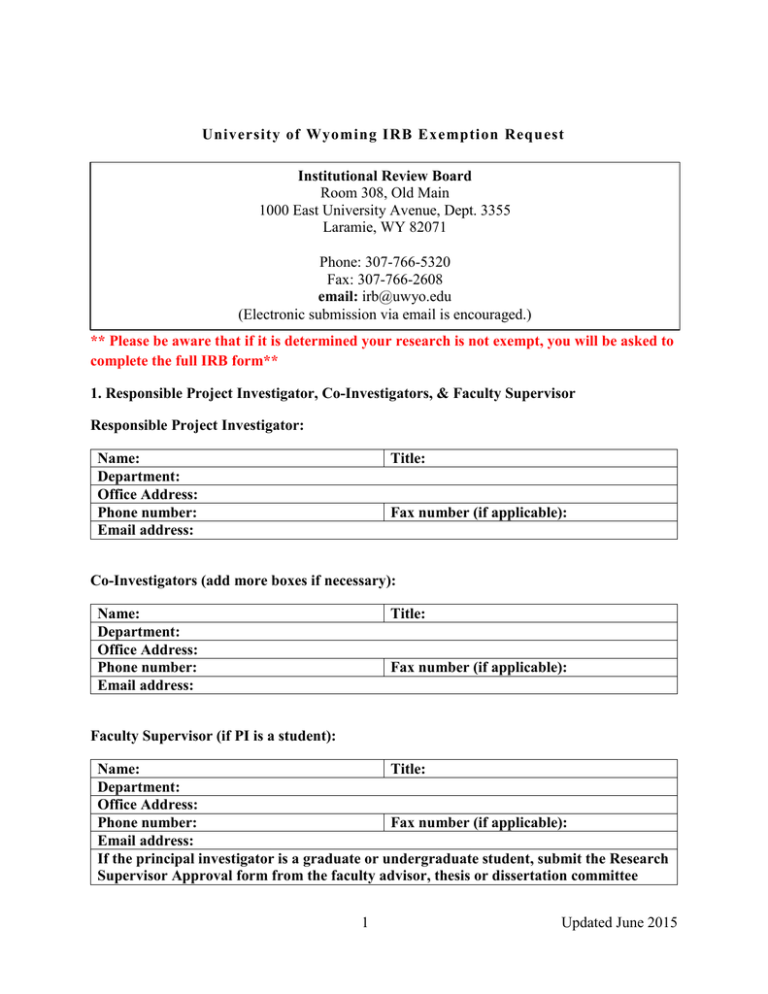

Exemption Request Form June, 2015, Why did the income tax rate only change for tax year 2025? Michigan pension and retirement payments withholding tables:

Fuel Allowance Form Michigan Edit, Fill, Sign Online Handypdf, 2025 michigan income tax withholding tables: Short answer michigan personal exemption 2025:

Fillable Form 3372 Michigan Sales And Use Tax Certifi Cate Of, The income tax rate may decrease each. When do i have to file my taxes?

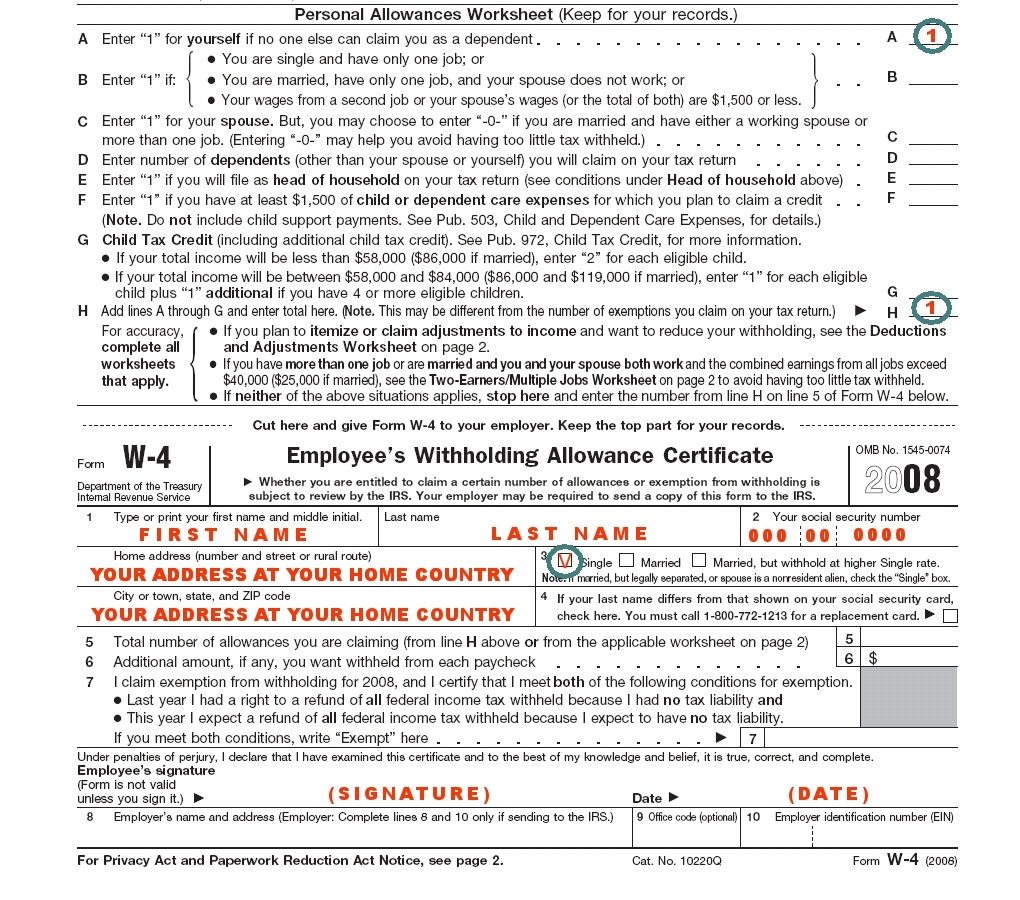

Michigan Employee Withholding Form 2025 2025 Employeeform Net Vrogue, Exemption allowance = > $5,400< x number of (personal/dependency) exemptions. Individuals and fiduciaries subject to tax under part 1 of.

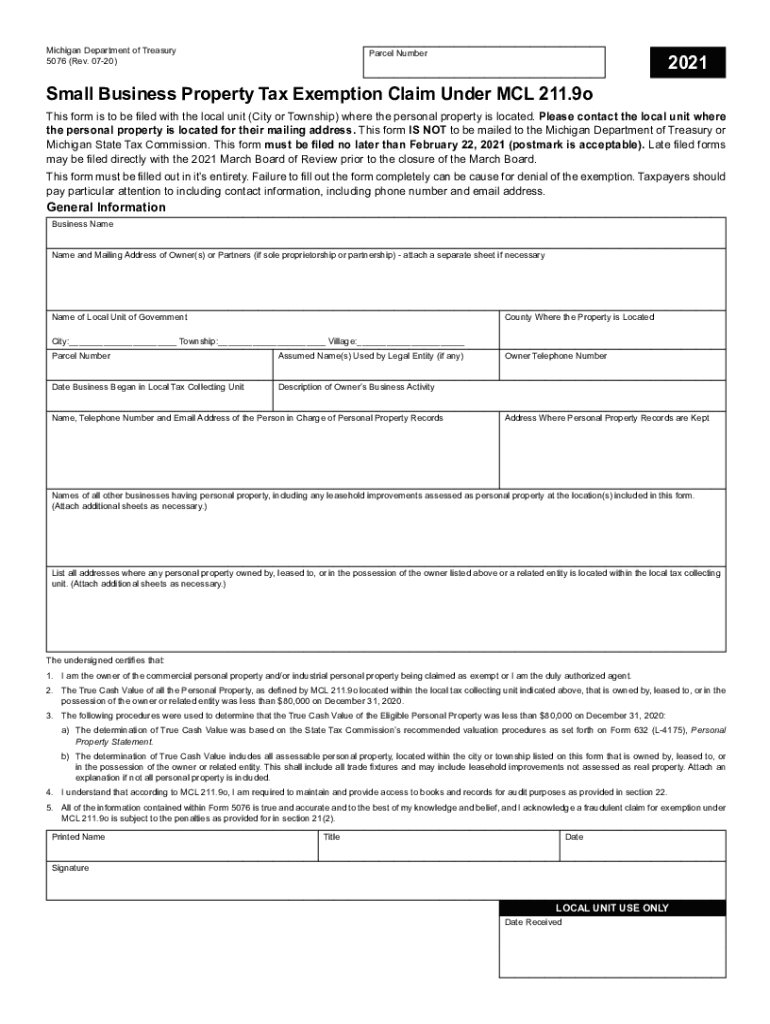

MI 5076 2025 Fill out Tax Template Online US Legal Forms, The annual allowance amount, per exemption claimed, has changed. Multiply the result of step 5 by 4.05 percent to obtain the amount of annual michigan tax.

Federal W4 Form Printable, The michigan department of treasury released an updated 2025 individual income tax withholding guide. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married.

The death of an individual entitled to family allowance terminates the right to allowances not yet paid.

Best Buy Hacked 2025. Use a free online tool to scan for viruses and spyware. Previously, best buy showed interest…

2025 Debate Topic. It has to be meaningful, interesting and unique! Good ideas for a debate aren't easy to come…

Neymar New Club 2025. Feb 5, 1992 (32) place of birth: August 16, 20233:47 am pdtupdated 7 months ago. Neymar…