Long Term Capital Gains Rates 2025. Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. Contents [ show] capital gains are taxed as per the tenure of holding investments.

The gains on investments are broadly classified. Their plan would add more than $3 trillion to deficits over 10 years, while providing tax cuts worth $175,000 per year to the top 0.1 percent of americans.

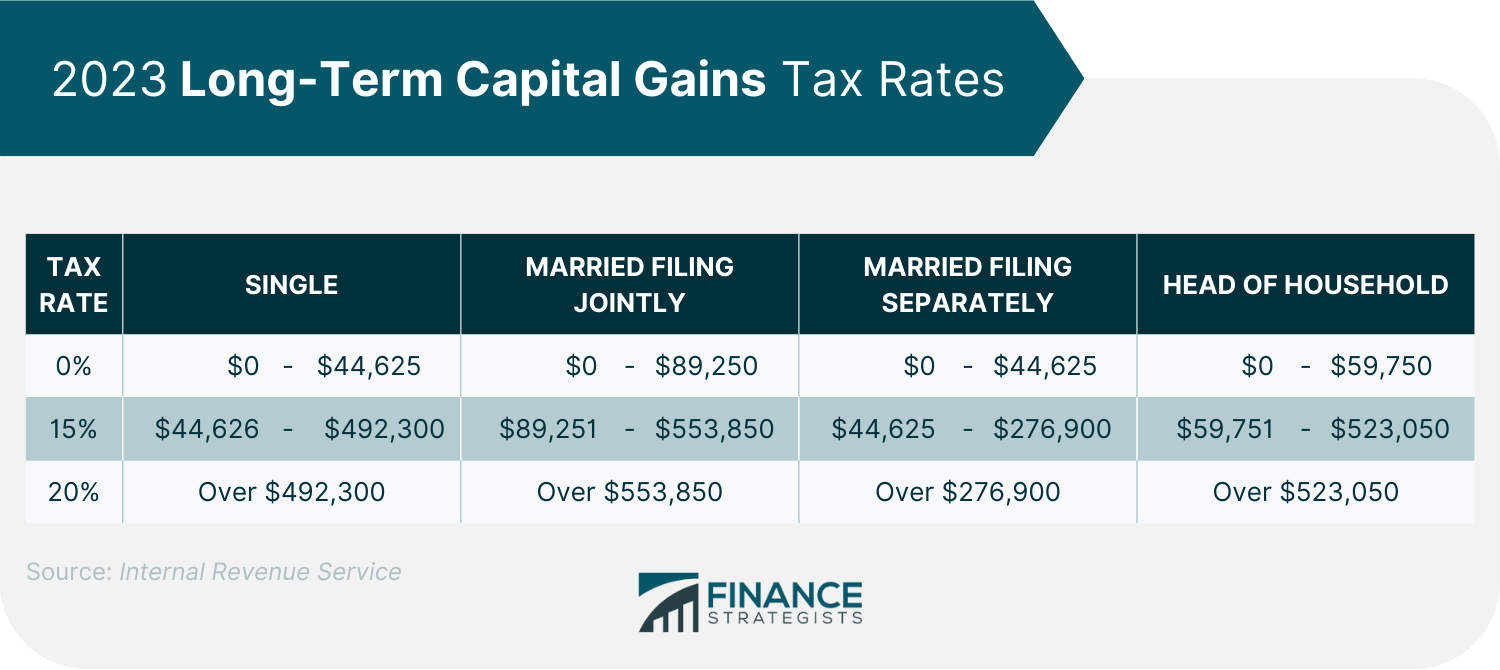

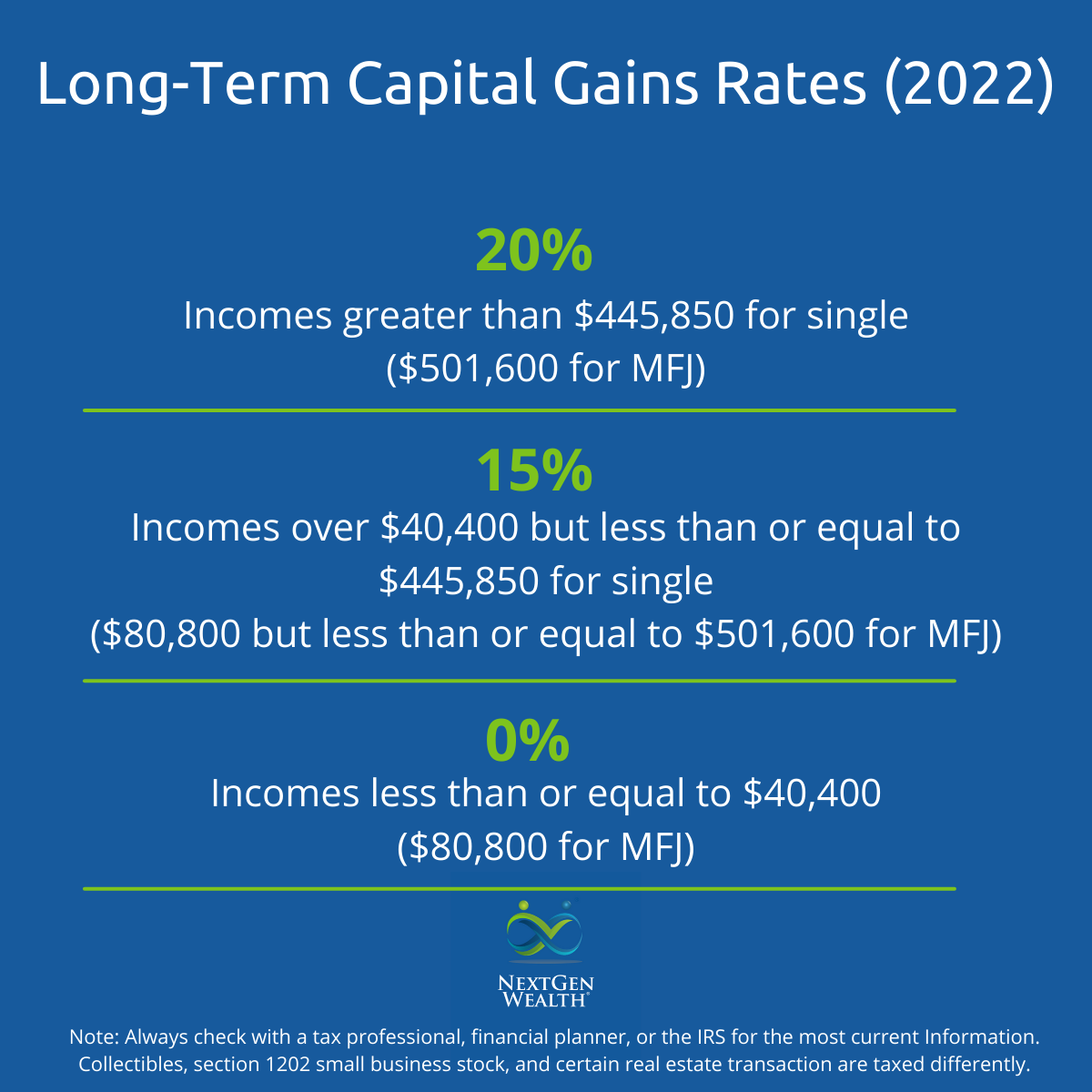

Capital gains rates for individual increase to 15% for those individuals with income of $44,626 and more ($89,251 for married filing joint, $44,626 for married filing.

Any profit or gain that arises from the sale of a ‘capital asset’ is known ‘income from capital gains’.

2025 Schedule D 2025 Capital Gains Tax Rates esme laurice, 2025 and 2025 capital gains tax rates. Written by true tamplin, bsc, cepf®.

Current Us Long Term Capital Gains Tax Rate Tax Walls, Written by true tamplin, bsc, cepf®. Published 6:00 am edt, thu january 4, 2025.

Capital Gains Tax A Complete Guide On Saving Money For 2025 •, Hunt also cut the higher. Under the new rules, a holiday let landlord who earns £30,000 in rent will have to pay about £4,000 a year extra in income tax.

How To Calculate Long Term Capital Gains Tax (2025), Capital gains arise from the sale of a capital asset like bullion, a house, a vehicle, heavy equipment, stocks, etc. Capital gains are the profit from.

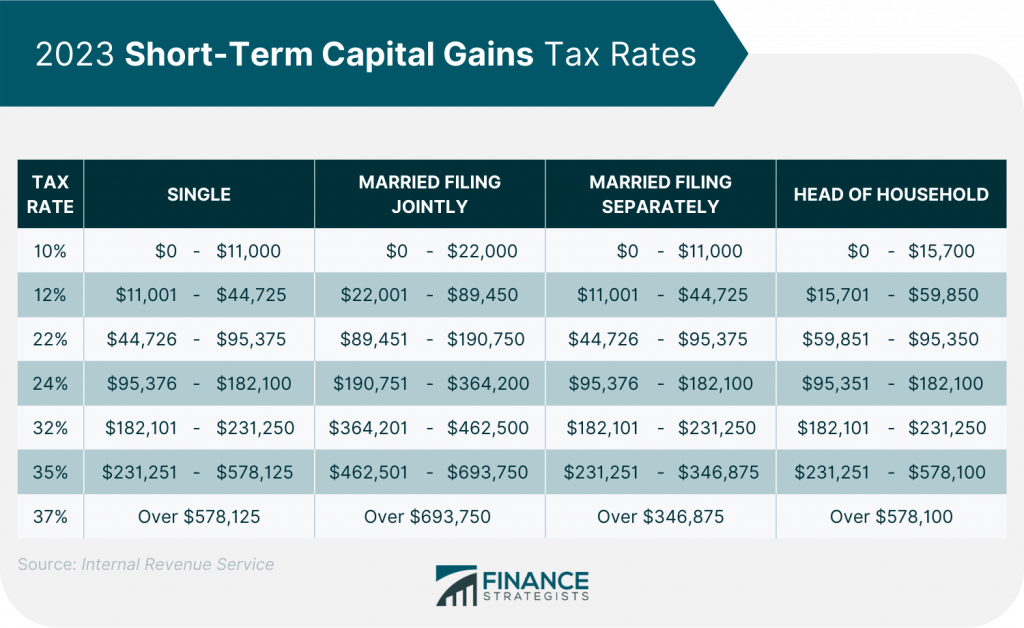

ShortTerm And LongTerm Capital Gains Tax Rates By, 2025 capital gains tax rate. What is cost inflation index?

LongTerm Capital Gains (LTCG) Meaning, Calculation, Example, The gains on investments are broadly classified. Reviewed by subject matter experts.

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, Contents [ show] capital gains are taxed as per the tenure of holding investments. Married filing jointly, eligible surviving spouses:

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, Capital gains arise from the sale of a capital asset like bullion, a house, a vehicle, heavy equipment, stocks, etc. 2025 capital gains tax calculator.

Can Capital Gains Push Me Into a Higher Tax Bracket?, The gains on investments are broadly classified. For taxable years beginning in 2025, the tax rate on most net capital gain is no higher than 15% for most individuals.

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, 2025 capital gains tax rate. Capital gains arise from the sale of a capital asset like bullion, a house, a vehicle, heavy equipment, stocks, etc.